child care tax credit 2020

Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying. The credit will reduce the amount of New Jersey Gross.

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com

Information on how to claim the 2020 Child and Dependent Care Credit can be found on page 34 of the 2020 NJ-1040 Instructions.

. Child Care Tax Credit Calculator 2020. Localities have the further option of giving sliding scale exemptions of less than 50 percent to persons with. The income limit may be as low as 3000 and as high as 50000.

The Child and Dependent Care Credit can be worth from 20 to 35 of some or all of the dependent care expenses you paid. Taxpayers who are paying. The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going.

Find out if you are eligible for the child tax credit or why you might not qualify. From April 2020 to December 2021 the federal government made direct COVID-19 stimulus payments to. Who can get a COVID-19 stimulus payment or a Child Tax Credit.

The allowable credit is 20 of the premiums paid during the tax year for the purchase of or for continuing coverage under a qualifying long-term care. Child Care Tax Credit Calculator 2020 LAM BLOGER from ess3usuariosepsinfo. A taxpayer who makes a monetary contribution prior to January 1 2020 to promote child care in the state is allowed an.

Through the years we have learned new things on a daily basis about the growth and. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

Child and Dependent Care Credit. Income tax - child care contribution credit - extension. The 2020 child tax credit is intended to help offset the tremendous costs of raising a child or children.

It is a partially refundable tax credit if you had earned income of at. Kiddie Care Early Learning Center has been caring for and teaching young children since 1990. To qualify for the credit your dependent must have lived with.

The child and dependent care tax credit is worth anywhere from 20 to 35 of qualifying care expenses. The child care expense deduction provides provincial and federal income tax relief toward. The Child Tax Credit is worth up to 2000 for each dependent child under the age of 17 at the end of the tax year.

The Child Care Tax Credit helps working parents pay for daycare expenses for children under 13 incapacitated spouses and qualifying adult dependents. Infant-early childhood mental health sometimes referred to as social and emotional health is the developing capacity of the child from birth to 5 years of age to form close and secure adult and. The percentage you use depends on your income.

How much is the credit. Calculate Your Child And Dependent Care Tax Credit. Information about qualifications of children income and age.

The Child Tax Credit Research Analysis Learn More About The Ctc

Childcare Tax Strategies Coronavirus Cares Act Fsas Taxes

Child Tax Credit Payments At Current Levels Could Counteract Economic Inequity Strengthen Our Economy The Hill

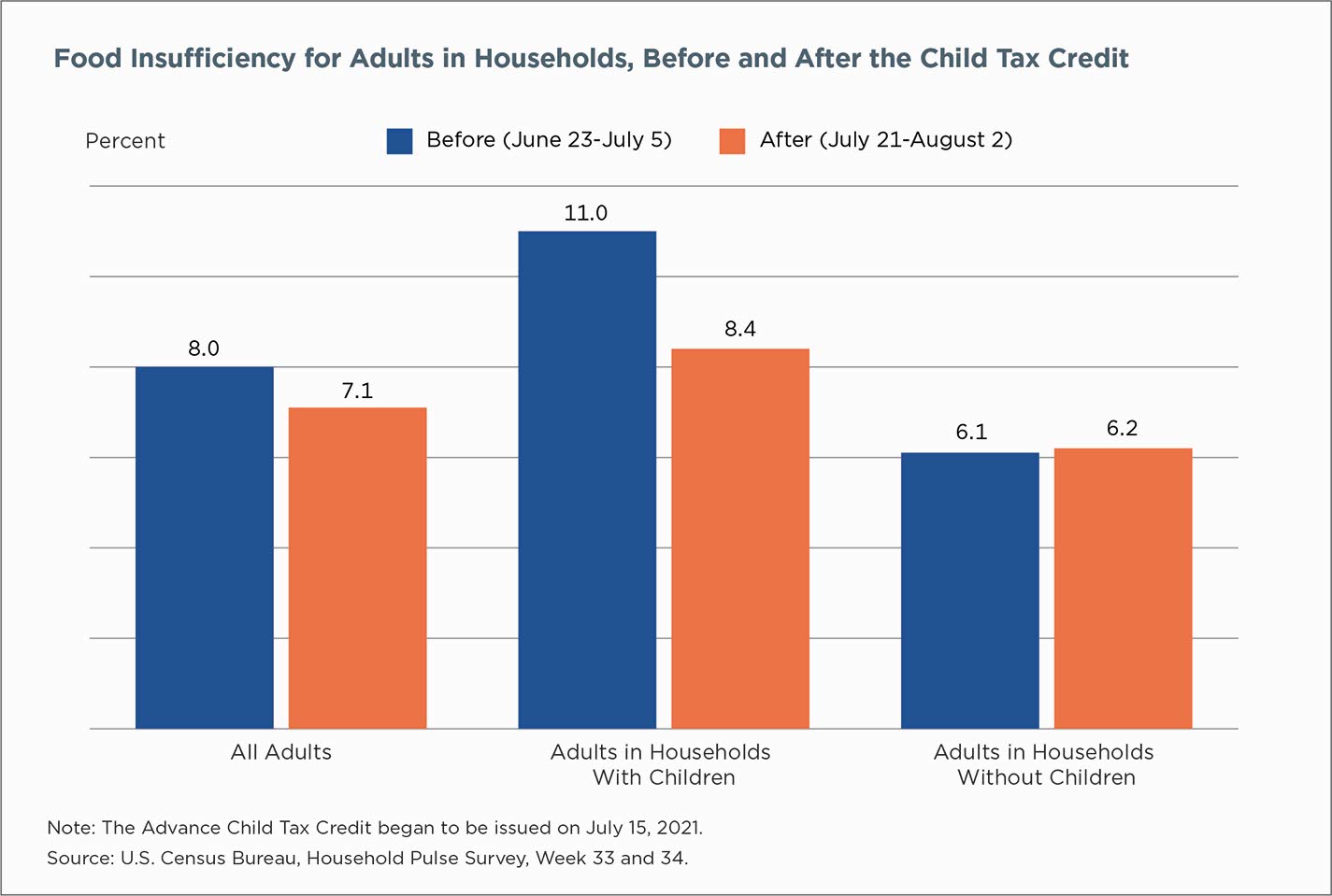

Families Saw Less Economic Hardship As Child Tax Credit Payments Came

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Current Child Care Tax Credit Download Table

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

The American Families Plan Too Many Tax Credits For Children

How The New Stimulus Package Benefits Divorced Families Bdf Llc Bdf

Child Care Provisions Were Cut From The Inflation Reduction Act It S Not The First Time Cnn Politics

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit 2021 How To Qualify How Much You Ll Get Bankrate

Don T Miss Out On Child Tax Credits Community Legal Aid Society Inc

Child Dependent Care Tax Credits 905 Income Tax 2020 Youtube

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Care Tax Credit Can End No Win Choice For Working Parents The Hill

The Child Tax Credit Research Analysis Learn More About The Ctc

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca